ECONOMY: Expansion Mode

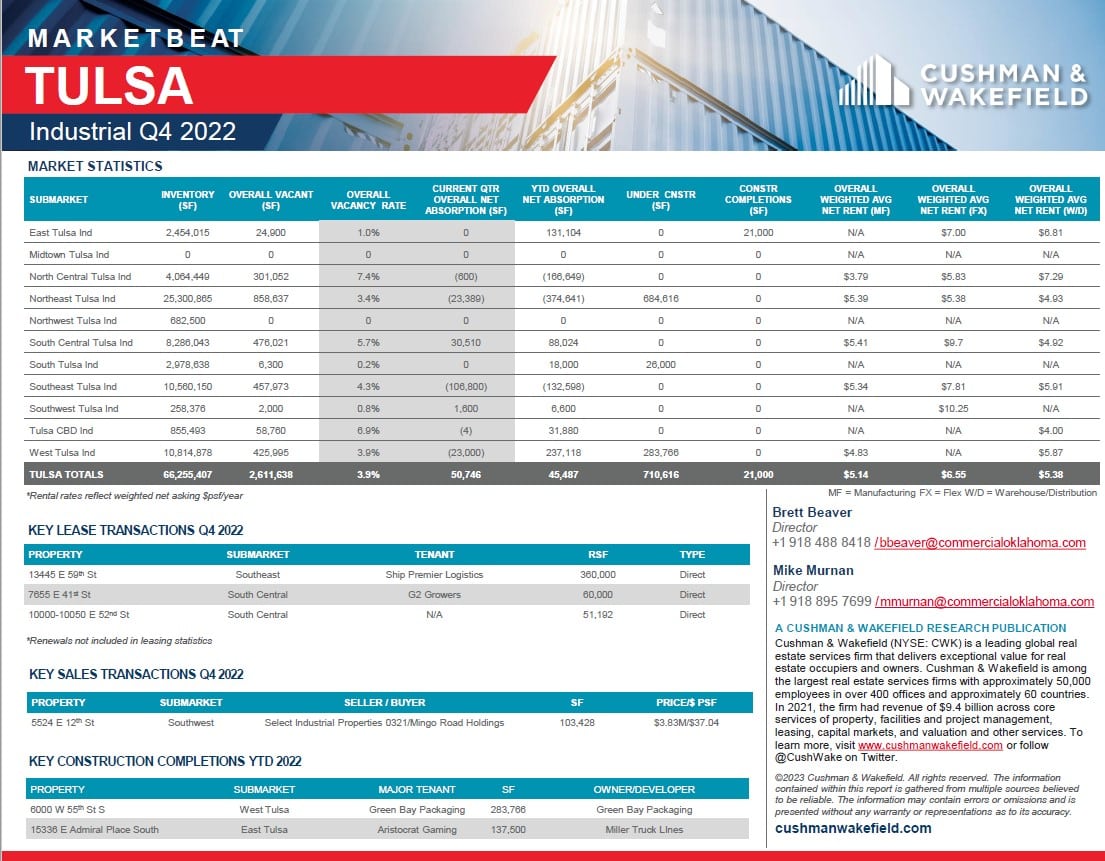

Tulsa’s economy has been steadily rebounding over the past year and is considered to have entered an expansion mode. The unemployment rate remained flat from Q4 to Q1 at 3.2% and the current workforce has dropped 6,800 from Q1 to 471.7K (up 4.8K YOY). Low rents, energy costs, and taxes help to make the cost of doing business in Tulsa 11% lower than the national average. Tulsa’s low cost of doing business continues to drive companies to the metro. With aviation, aerospace, and to some extent, oil and gas industries providing demand, the industrial market has remained stable.

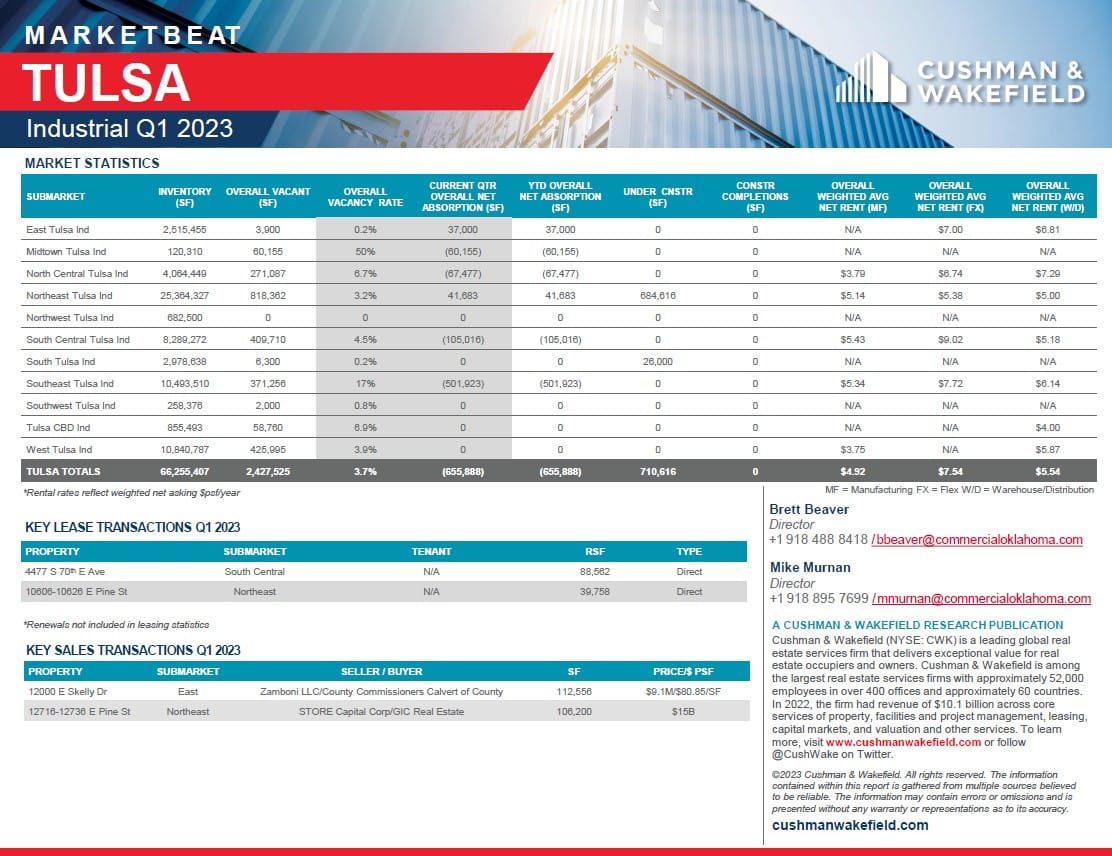

DEMAND: : Consistent Pace Into 2023

The Tulsa industrial market remains on stable footing with vacancy rates still trending at near lows. Overall, the industrial market is proving to be better insulated and is a point of strength in the commercial real estate market compared to other assets. Demand has continued to be focused on logistics properties, and development has reflected this growth. The passing of medical marijuana in Oklahoma has contributed to the budding demand for industrial space also. Consistent leasing has kept vacancy rates tight at 3.7%. In turn, annual rent growth measured 6.5%, the best performance on record. There has been a lack of speculative construction in the metro, resulting in increased competition among tenants, and rent growth has averaged approximately 3% annually over the past five years. Through the first quarter of 2023, the market has registered $26.6 million in annual sales , o n track for another strong year.

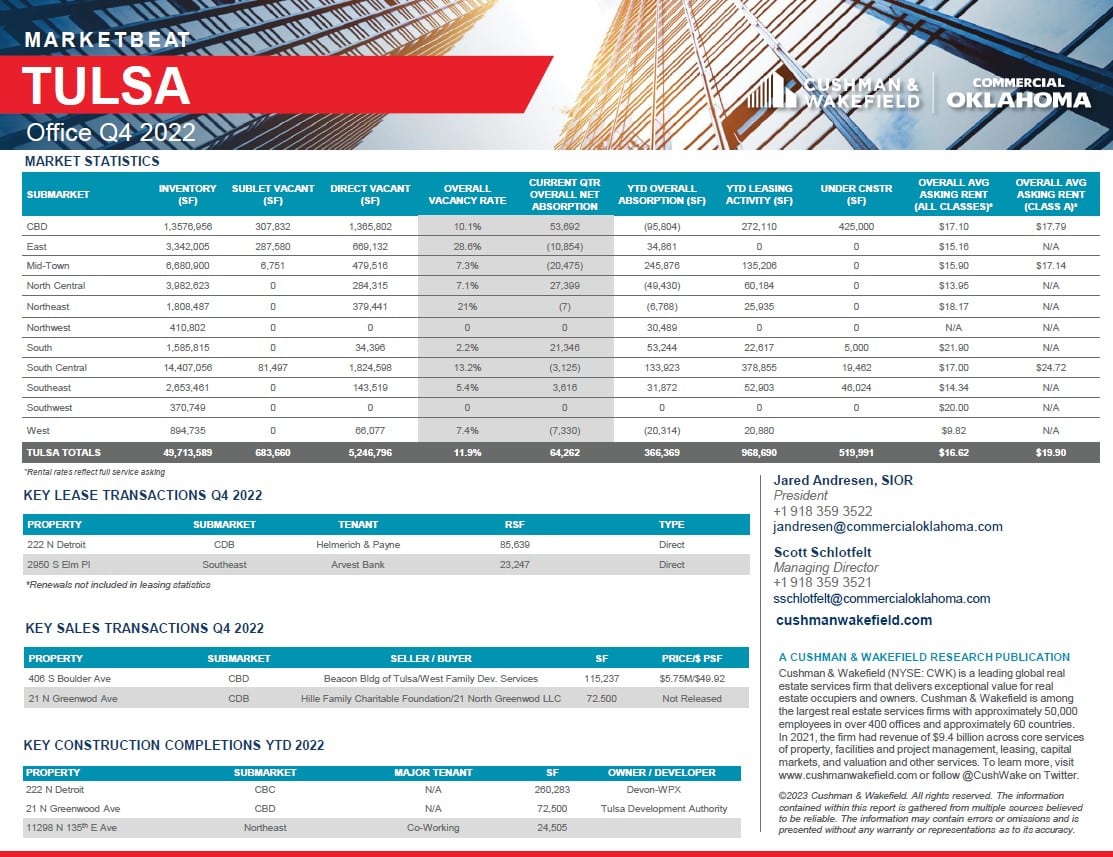

PRICING: Industrial Rents Soft Start to 2023

Overall Industrial Rents increased $.05/per square foot (psf ) since the fourth quarter. While Flex properties continue to boast the highest overall rents in Q1 2023 ($7.54 psf ) this category took a $0.07psf loss from Q4. Among the large area submarkets, the highest rents are found in South Central ($9.02 psf ), Southeast ($7.72 psf ), and East ($7.00 psf ) Tulsa. In contrast, rents are typically lower in the West ($4.90 psf ) and the CBD ($4.00 psf ). Asking rents come at a premium in warehouse space compared to distribution centers. Among large area submarkets, the highest rents are found in Southeast Tulsa ($5.79 psf Tulsa’s asking rents remain affordable relative to the national average and are on par with regional metros like Oklahoma City and Northwest Arkan sas .

Get In Touch

Get In Touch