ECONOMY: Consistent Outlook For 2023

Tulsa’s economy has been steadily rebounding over the past year and is considered to have entered an expansion mode. The unemployment rate remained flat from Q4 to Q1 at 3.1% and the current workforce has dropped 6.8k from Q1 to 471.7k (up 4.8k year over year). Low rents, energy costs, and taxes help to make the cost of doing business in Tulsa 11% lower than the national average. Tulsa’s low cost of doing business continues to drive companies to the metro.

DEMAND: Investment Activity Trending

Investment activity is trending higher in the Tulsa office market. The market is reporting $208 million in sales over the past year.

Steep move outs are in the rearview mirror as the market is reporting net absorption in the black through late 2022. Net Absorption has made a sizeable shift YOY from 60.3k to 18.5k in Q1 2023. The vacancy rate has decreased from 12.0% to 11.4% in the same timeframe. Through the fourth quarter, CoStar is reporting a total of 283,000 square feet (sf) of move ins by the end of 2022. While the market’s vacancy rate remains elevated, demand’s inflection point keeps vacancies from rising further. With improving demand , rent growth has also returned. Annual rent growth is positive at 1.0%. Despite moveouts over the past year, investors logged $3 28 million in sales in 2022, the highest volume reported on record.

Despite ongoing uncertainty surrounding the office market, the area is reporting annual rent growth of 1.4%.

PRICING: Small Market Rent Increase For Q1

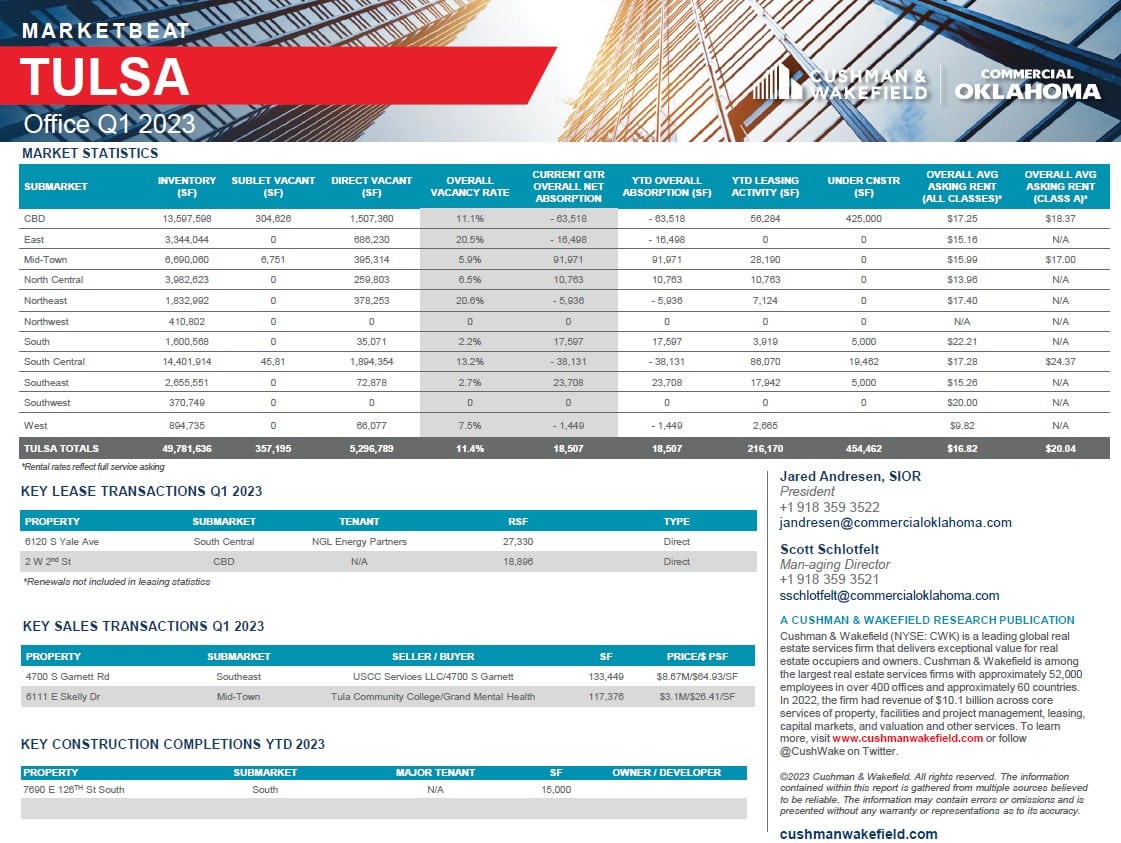

The Tulsa total market saw a $.17 per square feet (psf) increase finishing the quarter at $16.82 psf, with the total Central Business District (CBD) showing a $.15 ($17.25/psf) increase and Non CBD a $.17 ($16.59/psf) increase. Class A space continues to struggle with fluctuations in demand. Total Class A vacancies were up .08% (up 2% YOY) within the CBD and Non CBD. Class A vacancies were down 1.8% (down 4.2% YOY). The highest rents are found in the metro area outside of the CBD. The South submarket has the highest asking rent at $22.21/psf followed closely by the Southwest submarket at $20.00/psf, and all rank ahead of the CBD with a near $3/psf premium at $17.25/psf. Due to continued consolidations and closing in the downtown area, the CBD has struggled to see any significant rent gains.

Get In Touch

Get In Touch