ECONOMY:

As the US economy enters into its post COVID-19 era, the Oklahoma City economy continues to see a strong and resilient comeback. According to the St. Louis Federal Reserve and Bureau of Labor Statistics, Oklahoma City has performed better than the national average in Unemployment Rate and Employment Index. Although the energy sector has historically been one of Oklahoma City’s primary economic drivers, the Trade/Transportation/Utilities, Education & Health Services, Leisure & Hospitality, and Government sectors now rank higher when compared to the national average. Companies such as Paycom, Heartland Payment Systems, Costco, and Boeing have all announced expansions or relocations into the Oklahoma City market. This trend is expected to continue as companies find the market’s pro-business environment and quality labor force part of the region’s unique value proposition. Furthermore, the Oklahoma City Economic Development Trust’s Strategic Investment Program offers various economic development incentives for employers looking to expand existing operations into the city.

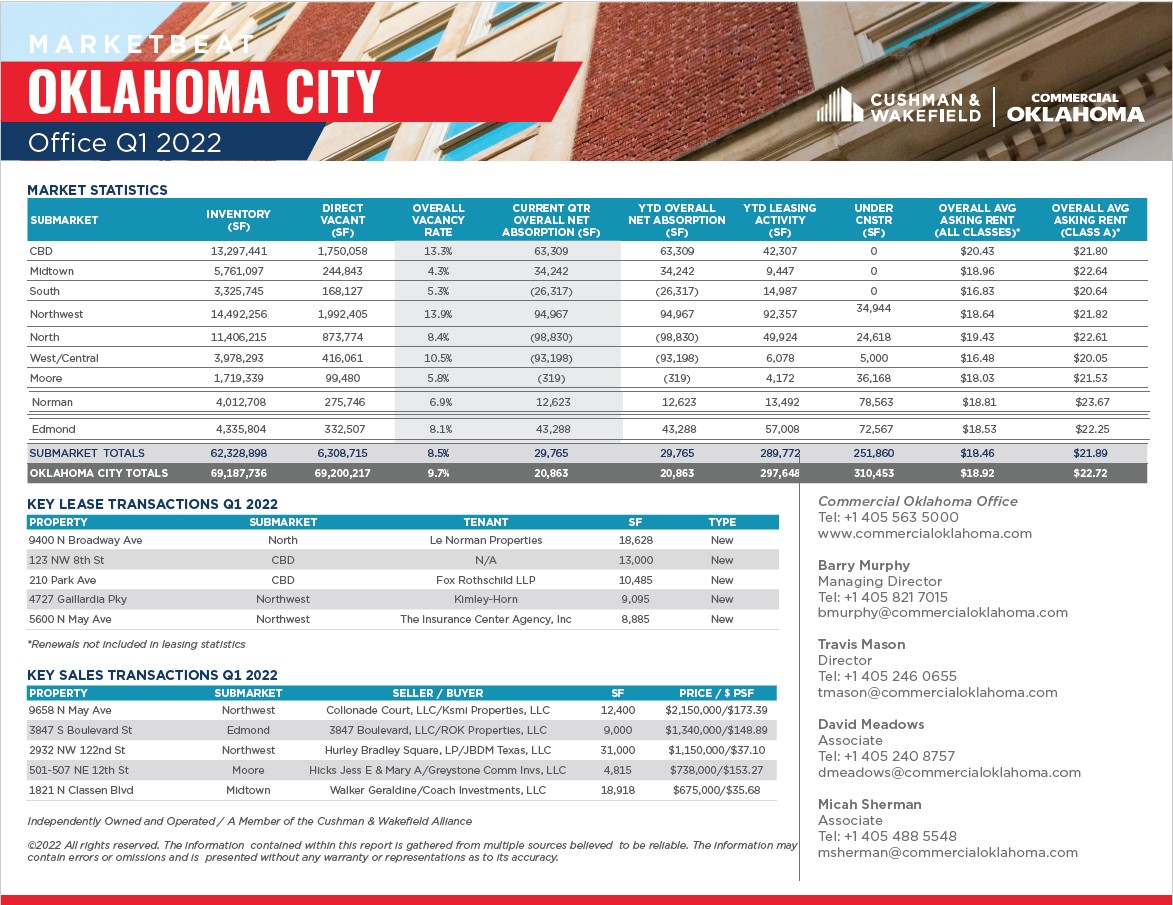

MARKET OVERVIEW:

Oklahoma City saw positive first quarter net absorption (+20,863 SF) for the first time in two years, which results in a fourth consecutive quarter of positive net absorption overall. Vacancy rates continue to remain below 10% for a third consecutive quarter and remain at least 2% below the national average for fourth consecutive quarter. Market rent growth in the OKC market continues to outpace the national average. For third party investors, the Oklahoma City market is seeing favorable trends in the areas of year-over-year transactional volume, increasing market sale price on a square foot basis, increased average sale price, and improving cap rates.

OUTLOOK:

The Oklahoma City office market is expected to have a strong 2022 with all measurable indicators setting the expectation that we will continue to recover well from the COVID-19 pandemic. Strong credit tenants, both local and national, are actively searching for new office space and executing multi-year leases. While we anticipate relatively stable rates going forward, ownership groups of office product should expect an increased spend on tenant improvements for the foreseeable future due to the inflationary environment currently seen in construction prices.

Get In Touch

Get In Touch